What is this Unified Payment Interface (UPI) all About ?

In the last few years, the digital payment system has revolutionized the way we transact money. The Unified Payment Interface (UPI) is one such innovation that has taken the Indian banking industry by storm. UPI has made online transactions easier and faster than ever before. In this blog, we will discuss the concept of UPI, how it works, its features, and the future of UPI.

What is UPI?

Unified Payment Interface (UPI) is a payment system that allows instant fund transfer between two bank accounts using a mobile device. UPI eliminates the need for traditional methods of transferring money like NEFT, IMPS, or RTGS, and instead uses a virtual payment address (VPA) to make transactions.

Who developed UPI Technology?

UPI technology was developed by the National Payments Corporation of India (NPCI) in 2016. The NPCI is an umbrella organization that is responsible for managing and promoting digital payments in India. NPCI is a non-profit organization that was set up by the Reserve Bank of India (RBI) and Indian Banks’ Association (IBA).

How Unified Payment Interface (UPI) Payment Works?

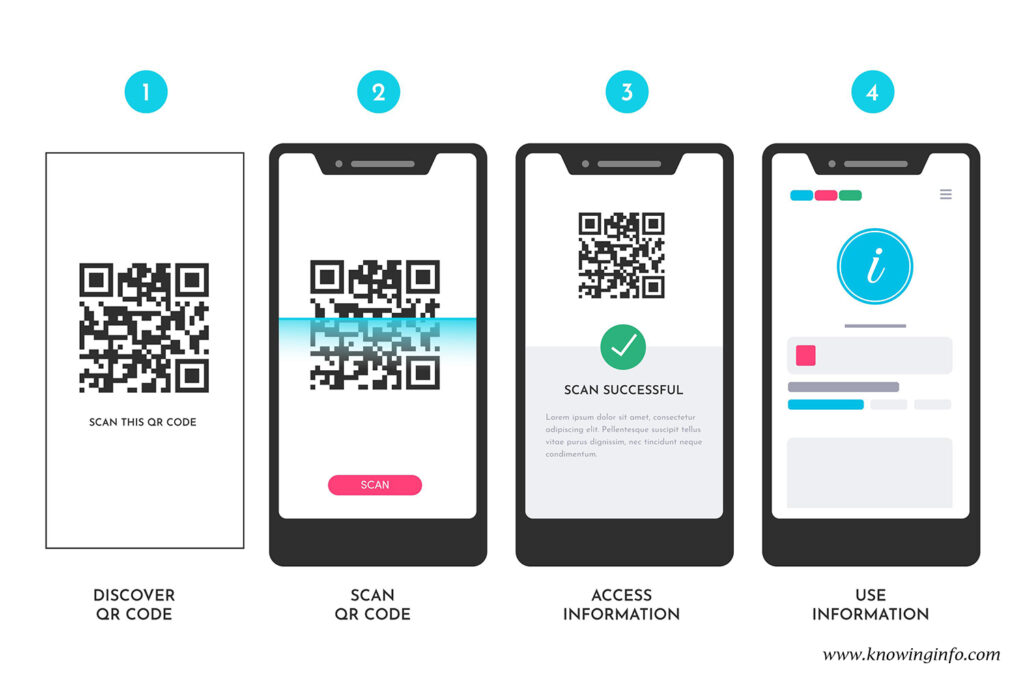

UPI payment works by using a virtual payment address (VPA) that is linked to your bank account. To make a transaction, you need to download a UPI-enabled mobile app from your bank or a third-party provider. Once you have downloaded the app, you can create a unique virtual payment address (VPA) that will be linked to your bank account.

To make a transaction, you need to enter the virtual payment address of the person you want to send money to. The UPI-enabled mobile app will then verify the details of the receiver’s account and transfer the funds instantly. The receiver will receive the money in their bank account instantly.

Features of UPI:

- Instant Transactions: UPI enables instant fund transfer between bank accounts. Transactions happen in real-time, which means that the funds are credited to the receiver’s account instantly.

- 24×7 Availability: UPI is available 24×7, which means that you can make transactions at any time of the day, even on weekends and holidays.

- Single App for Multiple Bank Accounts: UPI enables users to link multiple bank accounts to a single UPI-enabled mobile app. This means that you can manage all your bank accounts using a single app.

- No Additional Charges: UPI does not charge any additional fees for transactions. You only need to pay the nominal fee charged by your bank for using the service.

- Easy to Use: UPI is easy to use and does not require any technical knowledge. All you need is a UPI-enabled mobile app and a bank account.

Future of Unified Payment Interface (UPI):

The future of UPI looks promising. UPI has already gained a lot of popularity in India, and the government is actively promoting the use of digital payments. UPI has the potential to revolutionize the way we transact money, and it is expected to grow exponentially in the coming years.

How it is an innovation of modern payment systems?

UPI is an innovation in modern payment systems because it has simplified the process of transferring money. UPI eliminates the need for traditional methods of transferring money like NEFT, IMPS, or RTGS, which were time-consuming and required a lot of technical knowledge. UPI uses a virtual payment address (VPA) to make transactions, which makes the process faster and more convenient.

Conclusion:

In conclusion, the Unified Payment Interface (UPI) has revolutionized the way we make transactions in India. With its instant fund transfer, no transaction fees, multiple bank accounts, and third-party applications, UPI has become a preferred payment platform for millions of users. Its secure platform and mobile-first approach make it a modern and innovative payment system that is likely to grow in popularity in the years to come. The future of UPI looks promising, as it expands globally and continues to evolve to meet the changing needs of its users. With UPI, digital payments have become faster, safer, and more convenient than ever before.